Payments M&A Activities Picks Up in October

Payroc Acquisition of Atlantic Merchant: Key Details

October 19, 2023

What Is Smart Payment Routing and Why Would You Use It?

November 17, 2023After a period of decreased payments M&A activities earlier this year, the industry has recently experienced a surge in payment acquisition activity, which is predicted to persist throughout the remainder of the year. The payments industry is experiencing significant changes due to technological advancements and shifting consumer demands amid a volatile economic climate. This article sheds light on the payments M&A scenario within this dynamic sector.

We will discuss the trends observed in payments M&A activity during this month and the rest of the year and provide insights into what lies ahead beyond [year].

Current Payments Industry Trends

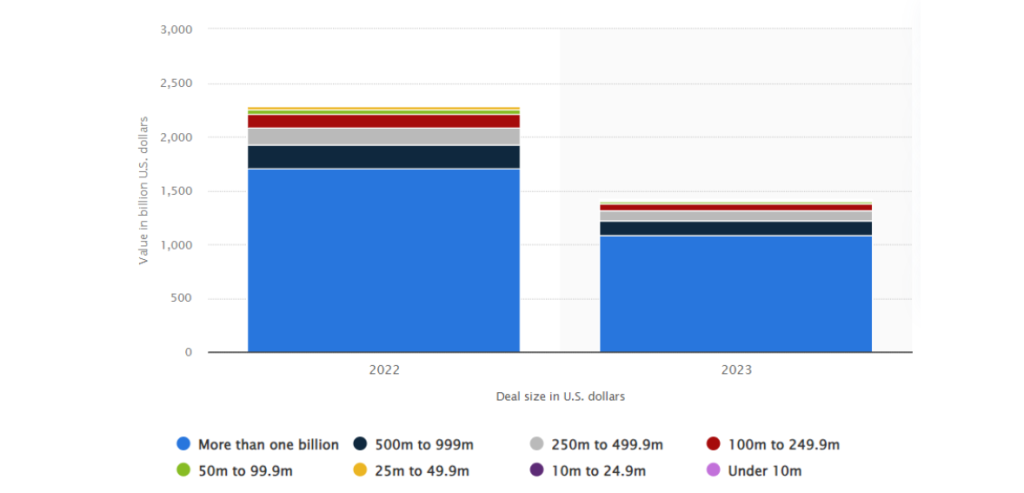

In the payments sector, we witness a marginal decrease in M&A activity, although this decline is comparatively milder than that observed in the broader tech/software domain. Valuations in the payments industry have also experienced a dip, albeit not as much as seen in the tech/software sphere.

Source: Statista – Value of merger and acquisition (M&A) transactions in the United States in 2022 and 2023, by deal value

A vital characteristic of the payments industry, namely, recurring revenue, remains highly coveted among acquisition targets. Such consistent revenue streams are viewed as a safety net by both buyers and lenders. Buyers continue to show a keen interest in payments M&A due to the reliable and recurring revenues intrinsic to the sector.

In the current year, compared to 2022, there has been a slight increase in deals involving the acquisition of an Independent Software Vendor (ISV) and those classified as non-Independent Sales Organizations (ISOs) in the payments domain. Meanwhile, acquisitions of an ISO have experienced a minor decline. Payment companies are now focusing less on the conventional approach of expanding through the addition of merchant portfolios, instead prioritizing acquisitions that enhance their technology, market reach, or infrastructure. Similarly to the broader market, we anticipate 2024 will witness a notably robust year for M&A activity, reflecting a substantial reservoir of pent-up transaction potential.

October And Previous Month’s Movement in Payments M&A

A resurgence in acquisitions within the payments sector has been noted in October, signaling a potential upswing in year-end activity. This month has emerged as the second most “best” period for M&A in the current year, with expectations of sustained momentum through the end of 2023 as payment companies actively seek acquisitions this quarter.

A notable focus in recent acquisitions has been on ISOs, with four out of nine deals in October 2023 involving this category. The appeal of ISOs lies in their ability to facilitate geographic expansion, access new technologies or solutions, and broaden customer bases. Notably, Stax, a payments technology provider, acquired Atlantic-Pacific Processing Systems, a payments processing software provider, during this period.

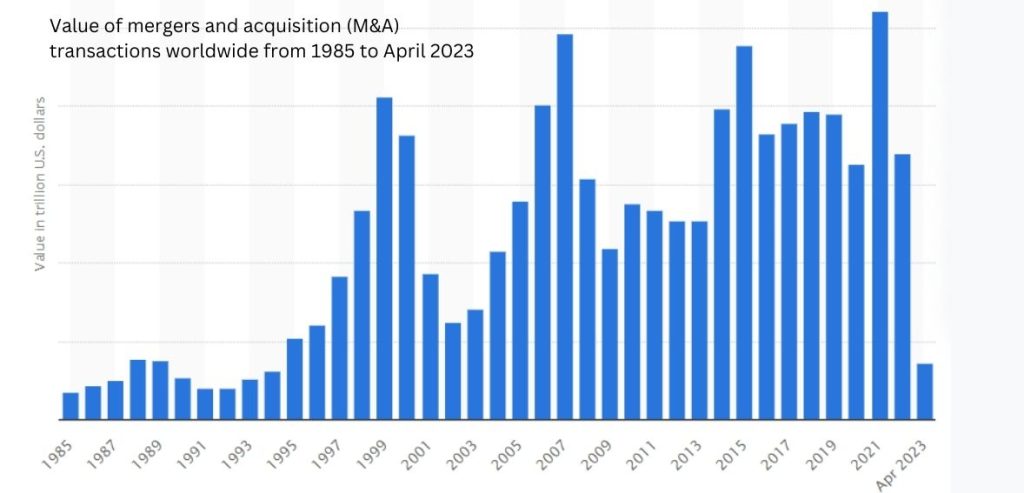

Source: Statista

Other significant deals this month included Shift4 Payments’ acquisition of a sports and entertainment business unit from SpotOn for $100 million, Fiserv’s acquisition of Brazilian company Skytef, and NMI’s purchase of the commercial division of payments software provider Sphere.

The payments M&A has experienced fluctuations throughout the year, with monthly deals reaching their peak in January, partially influenced by the previous month’s trends. Howеvеr, thе pacе gradually dеclinеd from February through July, with a slight upsurgе in August, followed by a dip in Sеptеmbеr. In comparison, 2023 has not matchеd thе momеntum of 2022, as еvidеncеd by thе tally of 114 dеals in 2022 compared to 58 dеals this year.

Notably, thе broadеr US’ M&A has obsеrvеd a dеclinе in activity. The total valuе of the US M&A dеals during thе first thrее quartеrs of 2023 saw a nearly 24% decrease from the corresponding period in 2022, undеrscoring a prеvailing trеnd of subduеd M&A activitiеs across various sеctors.

Payments M&A Activities In Q3 Taking Center Stage In FinTech

Payments M&A activity has witnessed a remarkable surge, constituting over 50% of the overall FinTech M&A scene. This figure marks a substantial increase from its 17% representation in Q3 of 2021 to 59% in Q3 of 2023. This notable growth is propelled by several critical factors, including technological advancements, the entry of significant tech players into the payment arena, and a highly fragmented payment market.

Aftеr a pеriod of dwindling paymеnt funding activity, invеstor intеrеst is on thе upswing in Q3 2023, with a total of $9.5 billion invеstеd thus far, significantly surpassing thе $3.8 billion sееn in Q2 2023. Notably, investors are shown a heightened focus on profitability, leading to a prеvalеncе of later-stage investments. Valuations in the payment sector have witnessed a substantial decline, primarily due to the increasing cost of capital and economic uncertainties. These factors have catalyzed heightened M&A activity in the payment industry.

Strategic and financial consolidators have also focused on the payment sector and have concentrated their acquisition efforts in Europe and the United States. Key focus areas within these acquisitions include money transfer, B2B payment, and payment processing. With the payment market’s continued expansion, many payment companies are driving the next wave of consolidation, indicating a dynamic and evolving structure in the FinTech industry.

Factors That May Have Caused Uncertainty in M&A Markets Throughout 2023

The uncertainty in M&A markets stems from various economic factors, including fluctuations in inflation, which, although showing a decrease from its peak in June 2022, has remained stagnant. This has impacted companies’ pricing power and demand, while the potential rise in financing costs further compounds the issue.

However, amidst these economic challenges, there is a silver lining in the form of potentially favorable tax policies for dealmakers in the years ahead. With changes in the political movements, the looming threat of capital gains tax hikes has subsided, offering a more favorable climate for transactions.

Talent shortages also have posed a significant hurdle for specific sectors and organizations with low unemployment rates in recent months. The recent waves of layoffs spreading across various industries have further complicated the situation, creating additional challenges in the restructuring process. The shift towards hybrid work arrangements and the increasing activism of employees have added another layer of complexity to the workforce, becoming a wildcard factor for potential deals.

Furthermore, external elements, such as geopolitical risks in different regions, disruptions in supply chains and economies, and the emergence of new virus strains, continue contributing to the overall uncertainty. While these factors are less detrimental than the disruptions experienced in 2020, they still play a crucial role in shaping the current structure of M&A markets.

Anticipating M&A Trends To Look For in 2024

With 2024 on the horizon, the M&A is poised for further transformations to reshape how companies approach these transactions. CEOs closely monitor these developments in a dynamic business environment that grapples with various challenges, such as supply chain disruptions, geopolitical tensions, and labor market constraints.

In this post-pandemic era, characterized by multifaceted complexities, CEOs face the daunting task of steering their companies toward success. Working with an assertive M&A strategy has become increasingly crucial in facing these challenges and boosting growth. These strategies need not solely rely on large-scale deals; instead, both corporate entities and private equity firms are focusing on mid-market transactions, which, despite being relatively more minor, can yield significant benefits.

Amidst the evolving business, M&A is a potent tool for CEOs and business leaders to adapt and innovate in the face of constant change. With the anticipation of a resurgence in M&A activities in 2024, recent surveys reveal that CEOs are actively considering strategic transactions within the next 12 months. The business world is witnessing a shift towards digital transformation, automation, and sustainable initiatives, all expected to shape the M&A trends in the upcoming year.

Prioritizing ESG in M&A Activities

The focus on sustainability has shifted from a mere preference to an essential aspect in M&A dealings. ESG considerations have gained significant prominence among businesses, investors, and stakeholders. As we look ahead to 2024, integrating ESG principles will play a central role in M&A transactions. This trend mirrors the increasing demand from clients and investors, emphasizing that companies will be assessed not solely on their financial performance but also on their dedication to sustainability and ethical conduct.

Buyers will meticulously examine the ESG performance of their targets and evaluate potential risks related to environmental and social issues. ESG factors will be seamlessly integrated into various stages of the M&A process, including due diligence, deal structuring, negotiations, and post-merger integration, underscoring their crucial role in the success of these transactions. As long as ESG factors align with financial performance, any political resistance is likely to remain merely a superficial reaction.

The Era of Digital Transformation

For the past decade, digital transformation has been a driving force behind M&A activities, and its momentum is expected to surge further in 2024. Companies spanning diverse industries have come to recognize that their survival and competitive edge heavily rely on their ability to adopt technology. The tech sector is anticipated to maintain its active pursuit of M&A deals as established companies and startups strategically acquire to solidify their positions.

Sustained investments in digital transformation are imperative for companies aiming to retain their competitiveness. We hold a positive outlook for potential M&A transactions in the technology, energy, healthcare, life sciences, and intelligent manufacturing sectors. Robust digital capabilities will undoubtedly serve as a critical strategic asset, whether companies are pursuing acquisitions or being pursued themselves.

Conclusion

The recent surge in M&A activity within the payments industry reflects a dynamic scene shaped by technological advancements and evolving consumer demands. Despite the economic fluctuations and uncertainties impacting the broader M&A market, the payments sector maintains a resilient position, with recurring revenue models serving as a critical driver for buyer interest. Notably, the recent surge in acquisitions, especially within the ISO category, indicates a growing emphasis on geographic expansion and technological enhancements.

Looking ahead to 2024, the payments industry is poised for continued growth and transformation, with digital transformation and ESG considerations emerging as pivotal themes in shaping future M&A trends. The integration of ESG principles will play a central role in M&A activities, reflecting the growing emphasis on sustainability and ethical practices. Additionally, the ongoing era of digital transformation is expected to drive sustained investments and strategic acquisitions across various sectors, cementing digital capabilities as a crucial strategic asset for companies at the front of the scene.