Important Trends Driving M&A in Merchant Services and Payments

Private Equity Firm GTCR Acquires FIS Merchant Services Business (Worldpay)

October 13, 2023

Payroc Acquisition of Atlantic Merchant: Key Details

October 19, 2023The payments industry is currently experiencing a transformative phase characterized by rapid technological advancements, shifting consumer preferences, and ongoing economic uncertainties. 2022 proved to be a year of challenges in the fintech, payments, and banking sectors, with more setbacks than successes.

To understand the trends driving M&A in payments and merchant services for 2023, we researched through various news channels, numerous news articles, and insights from industry analysts. This was to gain a comprehensive understanding of what they believe will define the most significant M&A trends in payments this year. Drawing from the top predictions in today’s landscape, here are some key trends driving M&A that are poised to shape the payments industry in the year ahead. But first let’s take a look in the previous and current market trends.

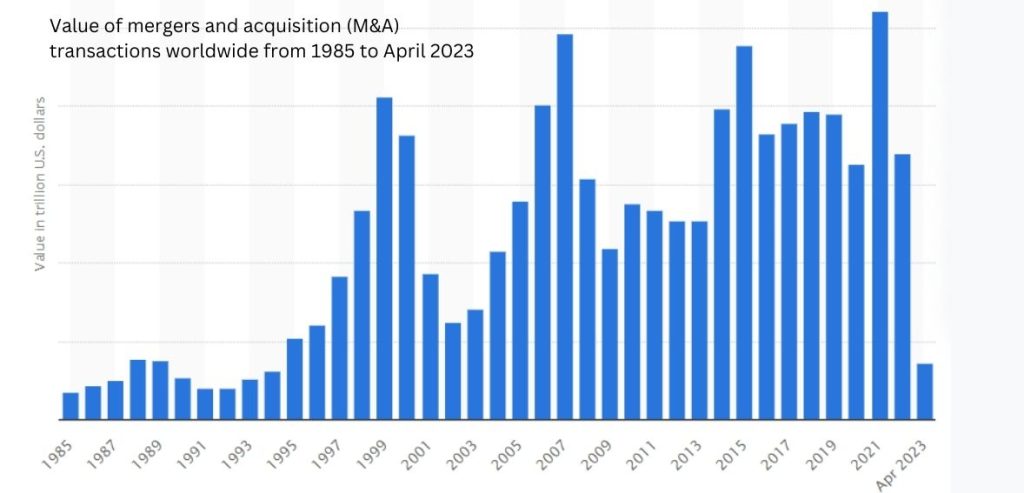

Trends Driving M&A In Previous Years – A Look Back

M&A activities paused in the mid-year of 2022 for reasons similar to those affecting various other industries. Market turbulence and the escalation of interest rates dampened enthusiasm on the buy side, while dwindling valuations on the sell side deterred quality assets from entering the market. Notably, the substantial growth witnessed last year in deals to support the “buy now, and pay later” sector significantly diminished in 2022, primarily due to various factors.

Source: Statista

Challenges such as intensifying competition, heightened regulatory scrutiny and mounting credit losses made both sellers and buyers fearful. Payment including merchant banking are still expanding rapidly. But they remain fragmented will soon consolidate. However, given the declining valuations, companies with no immediate compulsion to sell are opting to stay off the market.

Instead, the primary focus of dealmaking is shifting towards other areas where significant opportunities are emerging for companies that are willing to undertake bold initiatives to shape the industry, which we will talk about in the coming sections.

What The Current Market Of M&A In Payments Looks Like?

During the first quarter, online payments were central as many payment deals were announced in this quarter. It amounts to a firm value of $326.6 million. Notably, the largest deal (that was disclosed) in the industry during this period was Nexi’s majority acquisition of Paycomet and SLU, amounting to $295.3 million.

In terms of deal value, the activity related to online payments exhibited a remarkable 55% increase in this particular quarter compared to the previous quarter, which had a total value of $211.4 million. Furthermore, it surged by an astonishing 2780% compared to the same quarter in 2021. However, the volume of related deals saw a 10% decrease compared to the previous quarter, while it was still 80% higher than in 2022’s first quarter.

Moving into the second quarter, digital payments played a significant role in ten technology deals announced in Q2 2023, with a collective value of $1.4 billion. The most substantial deal disclosed in the industry during this period was Visa’s acquisition of Pismo Solucoes Tecnologicas for $1 billion.

Source: Reuters

In terms of deal value, payments-related activity in this quarter exhibited an astounding 45061% increase compared to the previous quarter’s total of $3.1 million and a remarkable 1674% rise compared to the preceding year. Furthermore, the volume of related deals increased by 43% this quarter compared to the previous quarter and was 67% higher than in 2022’s second quarter.

Key Trends To Mind In M&A In The Payments Sector – 2023 And Beyond

The landscape of payments M&A is continually evolving, shaped by a series of significant trends. In 2021, the industry witnessed a flurry of deals, often characterized by their high valuations. However, 2022 marked a noticeable decline in M&A activity within the payments sector. As we navigate through 2023, we anticipate further shifts in the payments M&A arena, driven not only by broader global economic factors but also by the inherently dynamic nature of this sector.

Several key trends in the payments industry are influencing the deals, either way, that are currently taking place:

1. Emergence Of “B2B 3.0”

In 2023 and further, we are on the cusp of a new era in B2B payments. It is characterized by a secure, digital, flexible and swift outlook. The prevalence of B2B payments through smartphones is on the rise as businesses increasingly prefer to transact payments through their smartphones using different payment processors.

A growing number of B2B enterprises are using online payment options, with an anticipated 80% of all the B2B transactions set to be digitally by the year 2025. The ongoing digital transformation of business processes is expediting B2B proceedings and expanding integrated payments, reducing the reliance on traditional paper checks and invoices.

The “accounts receivables” are reaping the benefits by sending invoices online and getting payments online.

Meanwhile, payment processors networks and banks are making strides in exploring the potential applications of virtual cards. This momentum of innovation within the ecosystem is expected to introduce new features and functionalities.

2. Concerns Over Fraud And Data Breaches

As the world progressively embraces a “hybrid” workstyle, fraudsters are keeping pace, continually refining their tactics and devising novel ways to deceive consumers. With an increasing number of individuals paying for flights, accommodations, meals, and various purchases while on the move, cybercriminals find themselves presented with more opportunities to exploit sensitive data.

The resurgence of travel is expected to be accompanied by a surge in cross-border fraud cases. Small businesses, in particular, are poised to remain prime targets, primarily due to their limited resources and a potential lack of expertise in prioritizing security measures and protective mechanisms.

Recent surveys have shed light on the prevailing concerns surrounding cybersecurity and data privacy, jointly ranked at the top (48%) in terms of the anticipated impact of regulatory changes over the next five years. This concern significantly overshadows the second-ranking issue, authentication and digital identity (31%), and stands well ahead of both (CBDCs) and cryptocurrencies, which share the fifth position in the rankings (28%).

3. Data Is Of Core Importance

In M&A activities within the Merchant Services and Payments sector for 2023, data assumes a pivotal role. It functions as the guiding star for activities such as market analysis, valuations, risk evaluation, synergy identification, and post-merger integration. Within an industry characterized by swift transformations and ever-evolving regulations, data stands as the linchpin, enabling informed decision-making and the establishment of customer-centric, compliant, and competitive advantages.

Data has gained increasing prominence as a catalyst for reducing transaction costs, fostering growth, and bolstering the transition toward digitally empowered and inclusive economies. Particularly in emerging economic regions across Africa, payments are experiencing growth at a pace surpassing the global average, granting millions of previously “unbanked” people access to these services, in turn diminishing the reliance on physical currency.

The crux of this transformation lies in data. Payments, in essence, generate a treasure trove of customer data for banks, comprising information about the who, what, when, and how much of transactions. This wealth of data not only opens doors to novel revenue streams for payment-focused enterprises capable of monetizing this information but also exposes them to the intricate challenges and risks related to data privacy.

4. Shift Of Paradigm To Super Apps

A super app represents an all-encompassing mobile application that offers a diverse array of services and functionalities, streamlining users’ ability to execute numerous tasks within the confines of a single app, eliminating the need for multiple standalone applications.

Super apps are renowned for their expansive scope, including features like eCommerce, social networking, transportation payments, banking, and more. Given the breadth of services they provide, these apps often boast extensive user bases.

These transformative platforms have garnered substantial popularity in Asia. Notable examples include China’s WeChat and Indonesia’s Gojek, both of which harbor ambitions to extend their reach to other global markets.

Recent research findings shed light on a compelling trend; over 78% of respondents anticipate that Asian institutions will lead the charge in globalizing and converging at an accelerated pace compared to the rest of the world through 2025. In contrast, institutions in Europe and the Americas are expected to grapple with challenges in keeping pace with this rapid evolution.

5. The Ongoing Cross-Border Opportunities

The cross-border payments landscape remains a hotspot for deals that revolve around enhancing capabilities. The surging demand for establishing a standardized network of global corridors and versatile pay-in and pay-out mechanisms, including digital wallets, has been the driving force behind a slew of recent transactions. Notable examples include iBanFirst’s strategic acquisition of Cornhill, Fleetcor’s Global Reach acquisition, and the Ebury’s purchase of Bexs in the Brazil. While these deals often present opportunities for expansion, it is the enhanced capabilities that serve as the primary focus at present.

Remarkably, it’s not solely the domain of cross-border specialists that’s witnessing a surge in the integration of international alternative payment methods, which go beyond conventional card payments. We are also witnessing a continuation of the trend from 2021, where multinational gateways and B2B service providers are avidly extending their global reach to include an increasingly diverse array of local payment methods. In 2022, this quest for expansion led to significant transactions, such as PayRetailers’ acquiring Pago Digital and Paygol, Revolut’s acquisition of Arvog Forex.

6. The Emergence of Government-Backed Payment Infrastructure

In recent times, the development of payment infrastructure by governments has gained immense strategic importance. These initiatives are driven by industrial policies aimed at exerting control over financial flows and establishing government-owned digital and data platforms. Consequently, a proliferation of domestic payment methods has emerged, riding on the foundation of these state-backed infrastructures.

Notable examples from around the world include:

- FedNow: Launched on July 20, of this year. FedNow service provides novel payment channels, enabling banks, credit unions, and eligible financial institutions to furnish instantaneous payment services to their clientele. It empowers customers to conduct transactions within seconds, 24/7, 365 days a year. Similar to other Federal Reserve services, the FedNow Service is accessible to any depository institution qualified to maintain an account with a Federal Reserve Bank.

- UPI: UPI, launched in 2016 in India, boasts a staggering 260 million users in a country with a population of 1.4 billion. This digital public infrastructure, established by the NPCI, seamlessly connects over 300 banks and facilitates financial transactions through various mobile applications like Google Pay, PayTM, Amazon Pay, among others.

- Troy: Troy, a local Turkish payment card, is supported by more than 20 Turkish banks. Troy cards are also accepted for online transactions.

7. The Rise of Sustainable Payment Demands by Consumers

As we witness a return to a more mobile and active lifestyle, the undercurrent of sustainability and climate-conscious choices is becoming increasingly prevalent in the consumer landscape.

A striking 40% of global travelers have already expressed their willingness to pay an additional 2% for carbon-neutral flight tickets, reflecting their commitment to environmental sustainability. However, this intention has translated into action for only 14% of travelers so far. In 2023, we anticipate a significant shift, as more sustainable options become readily available, motivating consumers to align their actions with their principles.

Furthermore, the concept of “recommerce,” which embodies circular commerce principles like renting, refilling, repairing, reselling, and redistributing goods, is gaining remarkable traction.

In the coming year, we can expect to witness the emergence of card rewards tailored for consumers who prioritize sustainable choices and innovative tools that help individuals visualize the positive impact of their decisions on the environment when planning their activities.

Conclusion

As we venture deeper into 2023, the outlook for M&A activity remains dynamic, settling somewhere between the levels observed in the previous two years. The trends highlighted above are expected to persist, exerting their influence on both M&A transactions and the funding rounds of ambitious fintech startups. The current uncertainty that clouds investors’ perspectives will eventually dissipate, although the extent of this transformation remains uncertain.

Frequently Asked Questions

Q: What’s the prominent B2B payment trend for 2023?

In 2023, the most significant digital payments trend is the rise of embedded B2B payments. This streamlined, real-time solution seamlessly integrates into business platforms, eliminating the need for using multiple tools and simplifying the payment process.

Q: What’s the latest technology in payments for 2023?

Artificial intelligence is revolutionizing various industries, including finance. In 2023, we can anticipate further advancements in AI-powered financial applications. AI algorithms will analyze substantial volumes of financial data, providing valuable insights for customized risk management and fraud detection.

Q: What are the key trends in banking for 2023?

In 2023, banks are navigating an intensified competition for deposits and narrowing profit margins in the latter half of the year. To drive customer acquisitions, banks will explore new strategies, including mergers and acquisitions. They will target areas where generative AI is poised for significant growth.